Table Of Content

With few exceptions, as long as you make payments against the underlying debt a lien does not affect your ownership or possession of the property. The lien only affects your ownership if you miss payments and the creditor secures a judgment. At that point, you then only partially own the asset, subject to the amount in question. Once the debt is paid off, make sure the lien is removed from your record.

An involuntary lien

Liens can also be voluntary or involuntary (aka consensual or nonconsensual). A bank takes out a lien when a borrower is advanced a mortgage, making this a voluntary lien. For involuntary liens, a creditor may seek legal recourse by filing a lien with a county or state agency if a borrower defaults on a loan or other financial obligation. A home lien is the legal claim on physical property by a creditor.

Lien placed on Ye's Malibu home after going up for sale for $53M - Business Insider

Lien placed on Ye's Malibu home after going up for sale for $53M.

Posted: Wed, 10 Jan 2024 08:00:00 GMT [source]

Common entities that may put a lien on your home

SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Notify parties – Let all the parties know once you’ve filed the lien. The cost to file a lien varies from state to state, from $5 to $345. If you hire a lawyer privately, the process can run into the thousands, which is why a LegalShield membership makes so much more sense.

Understanding Home Liens

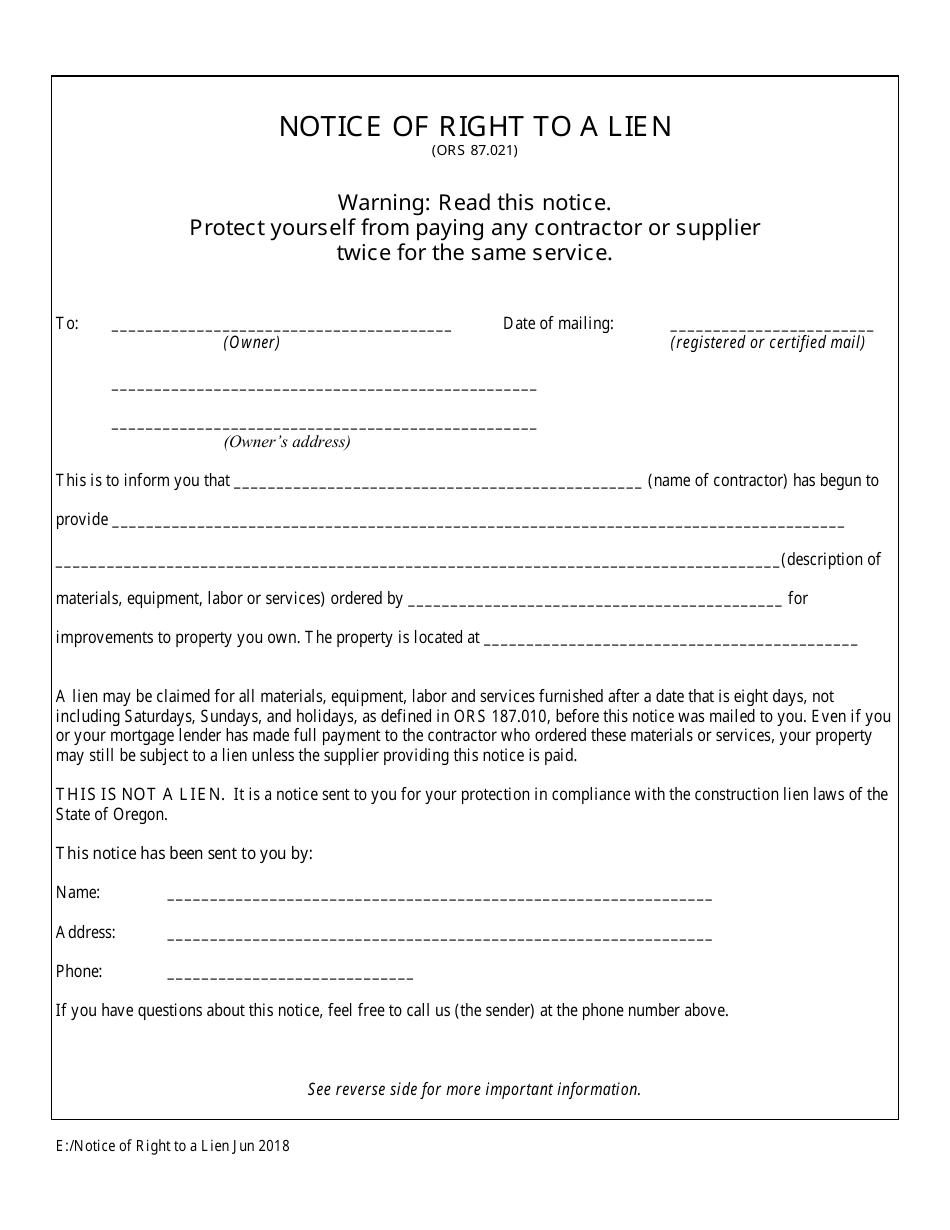

A mechanic’s lien, also called a construction lien, could be put in place if the owner fails to pay a contractor for work on the home. A mechanic’s lien is a type of involuntary lien that can only be placed against the property where the work was done. If you own other properties, real estate or assets, a mechanic's lien won’t apply to them. Once you pay for the work performed, the lien should be cleared. A judgment lien is another type of involuntary lien that’s the result of a court judgment against you.

Human And Social Services

It’s your best chance to at least keep some of the money involved. A lien is a legal claim placed on someone’s property, whether personal or business. It’s issued to settle a debt or enforce a judgment, or as a guarantee to secure payment on the same. Courts will often issue liens when the debtor either can’t or won’t pay in cash. Here’s what you need to know about liens, whether you’re a lender or a debtor, and how they work. You may want to consult with a financial advisor before agreeing to any liens on your property or talk to one immediately if you have received a tax lien.

Update: Lien filed on Del City man’s home after roofing company he hired didn’t pay supplier - KFOR Oklahoma City

Update: Lien filed on Del City man’s home after roofing company he hired didn’t pay supplier.

Posted: Sat, 17 Feb 2024 08:00:00 GMT [source]

Typically, the filing of a notice of commencement by the property owner or other top-of-chain party affects preliminary notice and... A secured debt is among the few types of debt that can survive a bankruptcy. The bankrupt party will be forced to sell off certain (non-exempt) assets to pay off the secured debts. When a property is foreclosed, there is only so much money to go around to pay all of the creditors. Even if you have the money to pay off the debt, you will need to speak with the creditor to understand available payment plans.

Besides illegal repossessions, some lenders keep all of the proceeds of a sale regardless of how much money the debtor actually owes. Since liens are a matter of public record, you can likely search your county’s records online. So if your county clerk or county assessor’s office has a website, you may be able to do a property title search for your address.

Some creditors don’t need permission to place a lien on your property if you haven’t paid them. Other situations may also arise that cause a creditor to file a legal property lien claim. A mechanic’s lien can be filed by a contractor performing work on a home or car. If the labor is unpaid by the debtor a mechanic’s lien may be granted giving the laborer rights to the property.

How Are Credit Scores Affected?

If there are other liens already on the property, you’ll be in line behind them to collect. When liens go unsatisfied, a creditor may force the sale of the property or take possession of it to recover the owed amount. Liens do not transfer property ownership, but impose a financial claim on the property.

Searching for liens in-person means you’ll have to take a few trips to local offices. First, you’ll likely need to visit your local tax assessor’s office to get property tax information and the parcel number. Next, you’ll need to visit the clerk’s office to get a history of ownership.

All homeowners have liens on their homes until they pay off their mortgages. While these liens don’t hurt you because they’re voluntary, other liens can damage your finances and your credit rating. In most states, you can search for free by address through the county recorder, clerk, or assessor’s website. Alternatively, you can appear directly at the county’s office, or, for a fee, you can hire a title company to do the search for you. A creditor may decide to place a lien on the property after all attempts to settle a debt are exhausted. This means that the creditor has tried to contact the debtor to collect on the debt and has made no progress to settle what’s owed.

Prospective buyers may avoid a property to which someone else has a claim. The government issues a tax lien certificate when the lien is placed on the property. This document includes details of the property, the amount owed, and any additional charges such as interest and/or penalties. Municipal governments can sell these certificates at an auction to investors who pay an additional premium plus the outstanding amount. A lien is intended to protect a creditor and ensure that the debtor settles their financial obligations.

Because real property is typically the most valuable asset that a debtor has, they will be the first type of property that a creditor will typically go after with a lien. Below, we’ll cover some of the types of liens used on real property. It’s important to understand that, like most laws regarding personal property, liens are very specific to state and local laws.

No comments:

Post a Comment